|

| The red line shows the sell off two days ago at one point losing over a dollar in less than 5 minutes, and then dip buyers came in to support the metal. |

"Economic or market trend associated with some characteristic or phenomenon which is not cyclical or seasonal but exists over a relatively long period".

Saturday, May 28, 2011

Silver Update

Friday, May 27, 2011

USD and Related Issues

|

| Attempting to test 50dma, failed to clear 76.5 |

|

| looks a lot like copper, stuck in a range |

|

| Gold should have a nice day today, needs to close above 1525, support at 1515 |

|

| stuck in a trading range |

|

| Thwarted a sell off yesterday, that should be really bullish for metals today, nice hammer print! We need it to get through th 150 for a big move in PM's |

|

| Like oil and copper its in the upper end of range a break out would be bullish for the STP |

Victory!

|

| Take a look at the 3 moth daily chart, this is what a bottom looks like, multiple retests of the lows successfully bought and finally bid up, the MACD rapid decline tapers and begins to round out and is now in a bullish cross over mode. This chrat also shows us how almighty banksters attempt to print charts, letting silver rise when everyone (weakest volume of any period) is a sleep and then easily sell it off. So it looks like a double top in this latest recovery for silver, or a failed test of the 50dma. If this happened during the day say between 9am and 1pm I would disagree with my statement but this is just garbage and I just have to get used to it. "Playing in a mine field, occasionally shits gonna blow up". Monday is Memorial Day Holiday in the US for those of you who are not familial with it here is a good link. Contact someone you know who has served or who lost a loved one in this unnecessary human tragedy we call war. Have a peaceful weekend. LINK |

Thursday, May 26, 2011

USD and Related Issues

|

| Carry trade back on, USD down commodities up, looking for the CCI to break this short-term channel and test the 50, probably at the same time the USD index tests the 50, this is no coincidence! |

|

| Crude looks similar to CCI |

|

| If copper can get going above the 150would be bullish for all metals, i expect there to be an approach to the 150 but no break, depends how the dollar acts at its 50dma. |

Silver Retest Begins

S&P Recap for Thursday

|

| S&P needs to hold 1300 |

Wednesday's session began with a gap lower and quickly print the low of the day on the chart within the first few minutes. The opening hour was choppy with a five point up then down move but near the end of the first hour the equities found bids and began moving consistently higher until just before noon when the high of the morning was put on the charts. The next three hours were basically sideways trading as the advance/decline line moved higher, building strength. Then just after 3:00 pm the indices exploded higher. But the late day gains were not held and this is becoming an ominous pattern if you are long this market.

The volume today was much like the last few days: not exciting. But the intraday volume pattern today shows the largest volume spikes on the mid morning SPX advance and on the 3:00 pm rapid move higher.

The volume today was much like the last few days: not exciting. But the intraday volume pattern today shows the largest volume spikes on the mid morning SPX advance and on the 3:00 pm rapid move higher.

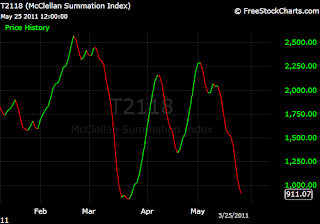

Checking the Breadth Indicators things still appear more bearish than bullish, but more choppy trade seems likely. While breadth was not impressive, the numbers are beginning to suggest something of a bottom forming, at least for a short term.

The McClellan Oscillator remains oversold but it has moderated the last couple of sessions.

40.2% of the SPX are above their five day moving average, 34.4% are above their 10 day average, 29.8% are above their 20 day moving average, 44.4% are above their 50 day moving average, and 76.8% are above their 200 day moving average.

Conclusion: Fundamentally the US stock market is a house built on a poor foundation, we are seeing it crumble as the end of QE nears and there is no news of further QE. This recent rally you are seeing is due to St. Louis Fed. Bullard's talk the other day and the EUR stabilizing for the moment. The futures are up slightly, lets see if we have a follow through day.

Wednesday, May 25, 2011

Secular Trends Update

|

Gold chart looks amazing here, very bullish above that 20dma and held the 50dma when Silver was hammered to scrap. |

|

|

It is good that this hasn't really started it's move up, so we have a way to go before the next pullback, this is a good contrary indicator. |

|

Oil is down huge, barely hanging on to the 150dma. Global slowdown strength in the dollar, great spot to go long but all this depends on monetary policy yesterday Bullard spoke and oil rallied along with everything else. If you believe in the long term trend, which is? QE to infinity then you buy right now. The DBA and MOO look pretty much the same but if you take a look at what happened in march this sell off isn't as bad as that one and was profitable to add at that point. Thats the beauty of a secular trend it will give you a chance to get in or add. |

USD Update

|

| DAILY |

|

| USD index got as high as 76.25 overnight and now stands at 76.02 it is firmly above the 50dma immediate term bullish but the long-term trend is down. The dollar continues to strengthen due to lack of talk of QE. As I have spoken about this before every body in the media has been talking about inflation and debt so the Fed will have to make people pay, show them where we'd be without QE (teach us a lesson so to speak). You see that the SPX has sold off hard everyday prior to Bullard's talk yesterday. I don't think the dollar will break below the 50dma until summer's end when I expect the SPX will be around it's 150dma or at the 200dma. The black chart is the UUP ETF of the dollar, shows a minor break of the up move, may head down a percent or two over the next couple or three days. |

Silver Update

![Live New York Silver Chart [ Kitco Inc. ]](http://www.kitco.com/images/live/nysilver.gif) |

| See the spike a little after 3pm est. thats when Bullard spoke in Missouri. We had a print of 36.63 in the access market and it continued its rally almost touching 37.5 around 5 am est. |

|

| No resistance till we get to 39, the only resistance will come from news margin hikes and FED speak (if its pro dollar). So if we don't get any negative news we should be at 39 by Friday. |

Tuesday, May 24, 2011

ECB’s Noyer Says Greek Restructuring a ‘Horror’

European Central Bank Governing Council member Christian Noyer ruled out a restructuring of Greece’s debt, calling it a “horror story” that would leave the nation shut out of financing for years.

“There’s no solution possible” for Greece other than its austerity program, Noyer, Bank of France governor, told reporters in Paris today. “Restructuring is not a solution, it’s a horror story.” If the country fails to meet the terms of its bailout, Greek government debt will be “ineligible as collateral” at the ECB, he said.

ECB leaders and European Union policy makers are clashing over how to prevent the currency region’s first default, after 256 billion euros ($360 billion) in bailouts to Greece, Ireland and Portugal failed to stop contagion from the debt crisis. A year after its 110 billion-euro rescue, Greece remains shut out of financial markets and the cost of insuring its debt against default is at a record high.

“The lengthening of maturities raises very difficult questions,” Noyer said. “There’s a strong chance it will be the equivalent of a default.”

Credit-default swaps on Greek debt increased 96 basis points to 1,496 today, after Prime Minister George Papandreou’s government backed a new package of spending cuts and state-asset sales yesterday. The yield on the country’s 10-year bond was down 18 basis points at 16.85 percent.

original article

“There’s no solution possible” for Greece other than its austerity program, Noyer, Bank of France governor, told reporters in Paris today. “Restructuring is not a solution, it’s a horror story.” If the country fails to meet the terms of its bailout, Greek government debt will be “ineligible as collateral” at the ECB, he said.

ECB leaders and European Union policy makers are clashing over how to prevent the currency region’s first default, after 256 billion euros ($360 billion) in bailouts to Greece, Ireland and Portugal failed to stop contagion from the debt crisis. A year after its 110 billion-euro rescue, Greece remains shut out of financial markets and the cost of insuring its debt against default is at a record high.

“The lengthening of maturities raises very difficult questions,” Noyer said. “There’s a strong chance it will be the equivalent of a default.”

Credit-default swaps on Greek debt increased 96 basis points to 1,496 today, after Prime Minister George Papandreou’s government backed a new package of spending cuts and state-asset sales yesterday. The yield on the country’s 10-year bond was down 18 basis points at 16.85 percent.

original article

A reason to rally

The St. Louis Federal Reserve President Bullard, speaking at a Rotary Club meeting in Missouri stated that it might be in the SECOND HALF OF NEXT YEAR that the Fed would begin to effectively tighten.The Fed Funds futures contract is signaling a move higher in the Fed Funds rate in the July 2012 contract.

This most likely is the reason we are seeing strength across the commodity sector today, particularly silver.

That buying was enough to take silver out of the top of its recent tighter range near $36. It has a chance now to make a run towards $39. I'm talking about physical.

This most likely is the reason we are seeing strength across the commodity sector today, particularly silver.

That buying was enough to take silver out of the top of its recent tighter range near $36. It has a chance now to make a run towards $39. I'm talking about physical.

Silver Target By Friday

Get ready to sell at 37.3-37.50 and buy back at 35.5, this is only for the people trading SLV paper.

|

| Important development, Silver just spiked up with volume through its intraday range, we may get to my target a lot quicker than I thought a few minutes ago. Time for short covering!!! Its a lot easier to write on the way up for some reason ;) edited 330pm est |

Silver USD

|

| Using the SLV for illustration purposes only. We have had a nice gap up this morning in the SLV and there really isnt any resistance now until 38. We should get there fairly quickly, that level marks a point where are ot of pain was felt and it will be a ough mark for Silver to get through so keep an eye on that to take some profits if you bought at 32-33 because we will certainly get some downward action from there. |

|

| Keep an eye on the USD, its rapid ascent is starting to taper off, however it is firmly above the 50dma and metals continue to rise, still no clue why? |

|

| Hourly chart of the UUP dollar ETF shows that the angle of rise was initially steep over a few days off the bottom and then consolidated for 5 or 6 days gapped up and the gap is now failing, this could have been the last ho-rah, but remember it still has support at the 50dma so its not going to go straight down. The metals strength could be a signal those folks are betting the dollar goes down? |

Metals doing well despite recent dollar strength

|

| USD |

|

| HUI |

Is QE really going to end and then where will the money come from to run the government. Will they start seizing 401k's to fund the deficits or government worker pension funds, will they nationalize businesses.

So what is the plan for us? I mean really what the heck is the big secret? Okay, so you stop QE now what? There is a week left and no one knows what the plan is, where is the money going to come from. Ask yourself, why are people bidding up the dollar or are they confusing the end of the eurozone leading to weakness in the euro and since the eur/usd are paired the dollar strengthens by default and not due to fundamental reasons.

|

| Silver |

They should have done that in 08 and then started over. They only people who benefited from all the bailouts and money printing were the

the banksters and auto makers etc.

|

| CCI |

In conclusion, I don't think anyone knows whats going on.

If there was a viable plan we'd have it already.

|

| Gold |

Monday, May 23, 2011

One of the Most Dangerous Banksters on the Planet – Jamie Dimon

JP Morgan Chase &Co has a pretty slick mouth piece telling anybody that will listen a lot of things that basically is a ploy to keep his traitorous ass out of prison. The former class A director of the New York Federal Reserve is a circus barker for the corrupt that helped bring American down. His predecessor Henry Paulson is a close second. What this clown wants to do should make the hairs on the back of your neck stand up. During an inquiry, Senator Bernie Sanders questions the Federal Reserve Lending practices of tax payer money, facilitated by the corporate mobster in chief below:

“Bernie Sanders, meanwhile, observes that Jamie Dimon was serving on the Board of the NY Fed at the same time as sucking at its teat.

Under court order, the Federal Reserve today identified more banks that took loans during the financial crisis using a once-secret system that Sen. Bernie Sanders (I-Vt.) called “welfare for the rich and powerful.”A Sanders provision in the Wall Street reform law already had forced the Fed last Dec. 1 to name banks that took trillions of dollars in emergency loans during the crisis.

“The Federal Reserve bailout was welfare for the rich and powerful and you-are-on-your-own rugged individualism for everyone else,” Sanders said. “The information released by the Fed today should never have been kept secret. This money does not belong to the Federal Reserve; it belongs to the American people. I applaud Bloomberg News, Fox News and others for their success in lifting another veil of secrecy at the Fed.”

Sanders said the latest disclosure raises questions about conflicts of interest. While Jamie Dimon, the CEO of JP Morgan Chase, served on the board of directors of the New York Fed, in one month alone, April of 2008, JP Morgan Chase received a combined $313 billion in Fed loans.

“This is an obvious conflict of interest on its face that must be investigated as part of the independent audit that my amendment requires to be completed this summer. When JP Morgan Chase was telling the world about their great financial success, it seems like they were using the Fed’s discount window as a giant piggy bank.”

What this slick CEO American bankster isn’t telling you is why he is so dangerous. This man must be watched extremely close. Preferably from a padded cell inside of Rikers Island prison.

“Bernie Sanders, meanwhile, observes that Jamie Dimon was serving on the Board of the NY Fed at the same time as sucking at its teat.

Under court order, the Federal Reserve today identified more banks that took loans during the financial crisis using a once-secret system that Sen. Bernie Sanders (I-Vt.) called “welfare for the rich and powerful.”A Sanders provision in the Wall Street reform law already had forced the Fed last Dec. 1 to name banks that took trillions of dollars in emergency loans during the crisis.

“The Federal Reserve bailout was welfare for the rich and powerful and you-are-on-your-own rugged individualism for everyone else,” Sanders said. “The information released by the Fed today should never have been kept secret. This money does not belong to the Federal Reserve; it belongs to the American people. I applaud Bloomberg News, Fox News and others for their success in lifting another veil of secrecy at the Fed.”

Sanders said the latest disclosure raises questions about conflicts of interest. While Jamie Dimon, the CEO of JP Morgan Chase, served on the board of directors of the New York Fed, in one month alone, April of 2008, JP Morgan Chase received a combined $313 billion in Fed loans.

“This is an obvious conflict of interest on its face that must be investigated as part of the independent audit that my amendment requires to be completed this summer. When JP Morgan Chase was telling the world about their great financial success, it seems like they were using the Fed’s discount window as a giant piggy bank.”

What this slick CEO American bankster isn’t telling you is why he is so dangerous. This man must be watched extremely close. Preferably from a padded cell inside of Rikers Island prison.

Silver Update

Silver has been building a base after the manufactured sell off which began May 1st. It continues to have extremely strong support at the 32-33 level, and has had three weekly closes in a row above 35. For today, if I get a chance to buy some paper it will be at the 34 level where is is some decent support, with the strength in the dollar (or the weakness in euro) we may get to 34.

There is an excellent post by trader Dan Norcini explaining what is going on inside the Silver market right now, see his commitment of traders report. He explains how the bullion banks are now going long and that hedge funds money levels in Silver are down to extremely low levels, not seen in a couple of years when silver was trading a lot lower in price.

Most people now know what the fundamental reason are for being in precious metals but if you don't read post by TF over at along the watchtower as he explains why QE can't and won't end and what to expect in Silver in the next few days, it is actionable information.

|

| dollar spiked up over 76 this morning |

|

| HUI sold off and recovered quickly this morning, HUI will lead metals higher |

Bottom line is that this isn't the time to panic and sell, this isn't the time to trade out of boredom, its time to be patient. A lot of damage has been done, lots of people lost lots of money, they are wounded, and need time to heal.

Subscribe to:

Comments (Atom)

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)