|

| S&P needs to hold 1300 |

Wednesday's session began with a gap lower and quickly print the low of the day on the chart within the first few minutes. The opening hour was choppy with a five point up then down move but near the end of the first hour the equities found bids and began moving consistently higher until just before noon when the high of the morning was put on the charts. The next three hours were basically sideways trading as the advance/decline line moved higher, building strength. Then just after 3:00 pm the indices exploded higher. But the late day gains were not held and this is becoming an ominous pattern if you are long this market.

The volume today was much like the last few days: not exciting. But the intraday volume pattern today shows the largest volume spikes on the mid morning SPX advance and on the 3:00 pm rapid move higher.

The volume today was much like the last few days: not exciting. But the intraday volume pattern today shows the largest volume spikes on the mid morning SPX advance and on the 3:00 pm rapid move higher.

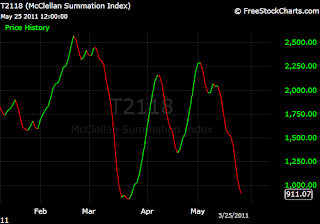

Checking the Breadth Indicators things still appear more bearish than bullish, but more choppy trade seems likely. While breadth was not impressive, the numbers are beginning to suggest something of a bottom forming, at least for a short term.

The McClellan Oscillator remains oversold but it has moderated the last couple of sessions.

40.2% of the SPX are above their five day moving average, 34.4% are above their 10 day average, 29.8% are above their 20 day moving average, 44.4% are above their 50 day moving average, and 76.8% are above their 200 day moving average.

Conclusion: Fundamentally the US stock market is a house built on a poor foundation, we are seeing it crumble as the end of QE nears and there is no news of further QE. This recent rally you are seeing is due to St. Louis Fed. Bullard's talk the other day and the EUR stabilizing for the moment. The futures are up slightly, lets see if we have a follow through day.

No comments:

Post a Comment