Silver is building a base to take off from, patience is required after the beating its taken there are a lot of people licking their wounds and no one is going to jump in here with both feet. I am actually glad to see it move sideways above the 150dma and gives me more confidence in the near-term for its prospects. No change in plan on how to trade this. Trimming around 39 and buying back around 32-33. Any break of the range will need considerable re-evaluation and Blythe has enough fire power to print whatever she wants on the charts.All about the dollar right now, the strength in the USD has definitely hurt all the holding in the STP along with the manipulation of the Silver market. USD Holding the 50dma, they may try and push it up for another try to breakout above 76 especially with all the IMF nonsense, and troubles in Europe.

"Economic or market trend associated with some characteristic or phenomenon which is not cyclical or seasonal but exists over a relatively long period".

Friday, May 20, 2011

SPX Thursday Recap

Good morning, the dollar is being bid up this morning and the S&P futures are down four points. Yesterday the DXY held the 50dma and is getting a nice bounce this morning. This will likely lead to a failed retest of the recent high if there is no breakdown today. The CCI is barely hold bull territory getting support at the 150dma. It needs to hold this or were going to be in for more downside to the SPX and everything commodity related. There is no economic data today.

Wednesday's session began without any kind of a significant gap, moved a bit lower early on, but quickly reversed higher and set the tone for the rest of the day. There was a three point pullback mid afternoon but most of the session was a slow, low volume ascent as buyers were not enthusiastic but neither were sellers. Yesterday appeared to be simply a continued technical bounce off of technical support.

Breadth was strong and and the the ten day average of Net Advancing popped into positive territory and it is nearing the 200 level.

The intraday volume pattern Wednesday shows three spikes in volume, all on index up-moves.

In the SPX Index there were 394 components advancing and 79 components declining. There were 122 new highs and 22 new lows. The five day moving average of New Highs is 133 while the five day moving average of New Lows is 32 and the ten day moving average of Net Advancing is 170.

63.8% of the SPX are above their five day moving average, 50.2% are above their 10 day average, 42.6% are above their 20 day moving average, 54.2% are above their 50 day moving average, and 80.8% are above their 200 day moving average.

Thursday, May 19, 2011

Dollar heads lower

A very important development that should not be taken lightly especially if you are long metals and other commodities. The dollar is suggesting more easing to come.

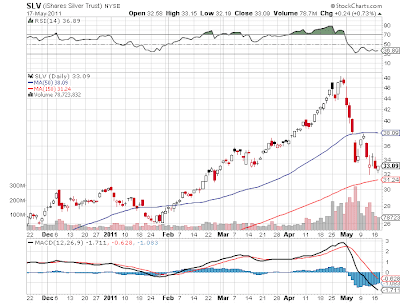

Silver Update

I wanted to put this up first because as I mentioned on my posts Tuesday that Silver had bottomed, on that day it was down, but up from the late night and morning raids and subsequent raids during the comex session but Silver failed to make lower lows. The HUI had bottomed on Monday. Note the rising RSI and positive, and MACD beginning to turn up. Remember historically the HUI leads the way.

Silver is forming a base right now, a level of support from 32-33 has been carved out and if there are no further margin hikes out of the comex we should trade between 39.5 and 34, and there will be less volatility so one could swing trade the range. The summer isn't very good for metals as Europe goes on vacation and its really hot in Asia and usually picks up by fall as they prepare for wedding season.

You also must remember the speculators that got their A$$ handed to them in the beginning of may, they will be selling and adding pressure (resistance) as they try to cut losses or break even. And a break of the trend line over 35.5 will encourage a move to 39. Right now we are sitting at 35.64, so there will be some short covering today.

35.5 is weak support, big time support 32-33. Major wall of worry to climb for metals, all this talk of bubble bursting, end of QE and dollar strength. All the talk will amount to NOTHING! And Silver will take out the recent highs by this fall.

Silver is forming a base right now, a level of support from 32-33 has been carved out and if there are no further margin hikes out of the comex we should trade between 39.5 and 34, and there will be less volatility so one could swing trade the range. The summer isn't very good for metals as Europe goes on vacation and its really hot in Asia and usually picks up by fall as they prepare for wedding season.

You also must remember the speculators that got their A$$ handed to them in the beginning of may, they will be selling and adding pressure (resistance) as they try to cut losses or break even. And a break of the trend line over 35.5 will encourage a move to 39. Right now we are sitting at 35.64, so there will be some short covering today.

35.5 is weak support, big time support 32-33. Major wall of worry to climb for metals, all this talk of bubble bursting, end of QE and dollar strength. All the talk will amount to NOTHING! And Silver will take out the recent highs by this fall.

Oversold Bounce: S&P Recap

SPX rallied 11 points yesterday as there wasn't really any economic data for market participants to weigh in on. The futures are up almost 5 points right now. We have a bunch of reports coming out this am like leading indicators, claims data as well as home sales and Philly fed, so lets see what that brings, it will move the market one way or the other.

Breadth was strong today and the ten day average of Net Advancing popped into positive territory and approaches the 200 level. There were 374 advancers vs. 79 decliners on the S&P.

Total tick for the day was 148,000 and the average tick for the day was 95. There were 77 ticks greater than 600 and 12 ticks more extreme than -600. There were 2 ticks greater than 1000 and no ticks more extreme than -1000. This tick action suggests institutional accumulation.

The intraday volume pattern Wednesday shows three spikes in volume, all on index up-moves. Checking the Breadth Indicators it is surprising to see so many of the indicators still pointing negatively. But the McClellan Oscillator has moved back out of oversold territory.

Wednesday's session began without any kind of a significant gap, moved a bit lower early on, but quickly reversed higher and set the tone for the rest of the day. There was a three point pullback mid afternoon but most of the session was a slow, low volume ascent as buyers were not enthusiastic but neither were sellers. Today appeared to be simply a continued technical bounce off of technical support. Lets see if we can hold that 50dma or even rally from here. You have to assume the data will be worse than expected, and that bodes well for continued QE by the FED but they haven't blinked as yet so lets see if bad news is good news for the markets.

Total tick for the day was 148,000 and the average tick for the day was 95. There were 77 ticks greater than 600 and 12 ticks more extreme than -600. There were 2 ticks greater than 1000 and no ticks more extreme than -1000. This tick action suggests institutional accumulation.

The intraday volume pattern Wednesday shows three spikes in volume, all on index up-moves. Checking the Breadth Indicators it is surprising to see so many of the indicators still pointing negatively. But the McClellan Oscillator has moved back out of oversold territory.

63.8% of the SPX are above their five day moving average, 50.2% are above their 10 day average, 42.6% are above their 20 day moving average, 54.2% are above their 50 day moving average, and 80.8% are above their 200 day moving average.

The dollar is barely hanging on to the 50dma, looks like its getting ready to roll over. The CRB found strength at the 150dma and remains in bull mode after this big time correction. Keep an eye on this relationship as June nears, the FED has to and will show its hand.

In a nutshell, you can do all the TA you want, its all about the "money printing". QE or not to QE, that's not even really a question, is it?

Wednesday, May 18, 2011

Inflation

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Peter Schiff on KWN

When asked about silver specifically Schiff stated, “Remember it went up to $50 from $30 almost as fast as it came down. I think if you just take a look at the long-term trajectory it’s still a big bull market. I think that $50 high is not going to hold...We are going to take that ($50 high) out and move a lot higher. We are suckering a lot of new short sellers into the market as people are comparing it to a bubble now or 1980, the Hunt Brothers. I don’t think what we’ve had so far is anywhere close to what happened in 1980. We might get to that point at some time in the future, but we’re not there yet.

We’ve created sufficient nervousness and anxiety in the market and enough shorts that we should have a nice wall of worry that we can climb, and ultimately a pretty good short covering rally. I think a lot of the people who have shorted this selloff in silver are going to lose a lot of money...We could have a dollar crisis as early as this fall and if we are having a dollar crisis then I would be expecting silver prices to be making new highs.”

We’ve created sufficient nervousness and anxiety in the market and enough shorts that we should have a nice wall of worry that we can climb, and ultimately a pretty good short covering rally. I think a lot of the people who have shorted this selloff in silver are going to lose a lot of money...We could have a dollar crisis as early as this fall and if we are having a dollar crisis then I would be expecting silver prices to be making new highs.”

KWN LINK

S&P Recap

Tuesday's session began with a significant gap lower and almost immediately began to bounce from the 50 DMA. Although the bounce was short lived the SPX did manage to close above the 50dma.

In the SPX Index there were 205 components advancing and 268 components declining. There were 83 new highs and 47 new lows.

The declining volume ratio was less than declining issues, this is bullish for stocks in the near term, we also have oversold conditions in the breadth indicators, especially the McClellan Oscillator. Also just 30% of stocks are above their 20dma and when that goes to 20% a meaningful rally usually occurs.

Looking for a rally into next week, lets see if the Ben Bernanke says something about QE3 as we get closer to June

The end of QE2 will lead to massive depression according to former Fed economist

What this implies, and what is also concludes is, that unless the Federal Reserve decides to continue Quantitative Easing (QE3), then every market in our economy will implode in a very short amount of time once the cheap money faucet is turned off. On top of this, the Federal government is in no position to cushion the fall since they no longer have a lawful right to borrow money, or implement taxpayer stimulus now that the debt ceiling has been reached.

Richard Koo has a very long and respected track record on analysis and economic projections. As a former economist with the Federal Reserve, and currently as the Chief economist for Nomura Equity Research, the leading securities house in Japan, his reports and analysis of global and national markets have been vital in advising numerous Prime Ministers during the Japanese banking crisis of the 1990's.

original source

Silver Update

|

| No coincidence, dollar probably done going up and metals done going down. |

|

| I put up the SLV to show the decreasing volume over the past 4 days, lack of conviction by the sellers. |

|

| As I mentioned yesterday, the HUI usually leads the metals in bottoming and it has held the recent low and has has had two up days, I'll feel better once it closes above Monday's high. |

Tuesday, May 17, 2011

I think the bottom is in

Disappointed!

Here is whats going on in the most popular Gold and Silver Blogs

NOTHING!

Where is all the timely advice? So freaking funny. Anyone can be right on the way up. Where are they on the way down. It's ok to say I dont know!

NOTHING!

Where is all the timely advice? So freaking funny. Anyone can be right on the way up. Where are they on the way down. It's ok to say I dont know!

The Great Heist Begins

Treasury to tap pensions to help fund government

By Zachary A. Goldfarb, Published: May 15

The Obama administration will begin to tap federal retiree programs to help fund operations after the government loses its ability Monday to borrow more money from the public, adding urgency to efforts in Washington to fashion a compromise over the debt.

Treasury Secretary Timothy F. Geithner has warned for months that the government would soon hit the $14.3 trillion debt ceiling — a legal limit on how much it can borrow. With the government poised to reach that limit Monday, Geithner is undertaking special measures in an effort to postpone the day when he will no longer have enough funds to pay all of the government’s bills.

Geithner, who has already suspended a program that helps state and local government manage their finances, will begin to borrow from retirement funds for federal workers. The measure won’t have an impact on retirees because the Treasury is legally required to reimburse the program.

By Zachary A. Goldfarb, Published: May 15

The Obama administration will begin to tap federal retiree programs to help fund operations after the government loses its ability Monday to borrow more money from the public, adding urgency to efforts in Washington to fashion a compromise over the debt.

Treasury Secretary Timothy F. Geithner has warned for months that the government would soon hit the $14.3 trillion debt ceiling — a legal limit on how much it can borrow. With the government poised to reach that limit Monday, Geithner is undertaking special measures in an effort to postpone the day when he will no longer have enough funds to pay all of the government’s bills.

Geithner, who has already suspended a program that helps state and local government manage their finances, will begin to borrow from retirement funds for federal workers. The measure won’t have an impact on retirees because the Treasury is legally required to reimburse the program.

The maneuver buys Geithner only a few months of time. If Congress does not vote by Aug. 2 to raise the debt limit, Geithner says the government is likely to default on some of its obligations, which he says would cause enormous economic harm and the suspension of government services, including the disbursal of Social Security funds.

Massive Asian Buying at 33

Any time we get into silver into the $33’s we get very, very big, high volume buying. This buying we are seeing out of Asia is thought to be continued diversification out of dollars, so the physical gold and silver which is being taken out of the market in that case is not expected to return.

This physical buying is part of an increase in hard asset reserves for China and other Asian countries who are underweight precious metals and it is expected to continue for quite some time, most likely for many years. Right now, each time we see gold under $1,500 the demand out of Asia is massive, they are huge physical buyers.

Some would say the paper market is diverging from the physical market and that is probably accurate at this time. Also remember that open interest may be indicating a rally in the very near future even if we have a bit more weakness.” Kingworldnews.com

Some would say the paper market is diverging from the physical market and that is probably accurate at this time. Also remember that open interest may be indicating a rally in the very near future even if we have a bit more weakness.” Kingworldnews.com

SPX breaking down

|

| US & Global economic slowdown, QE2 coming to an end. |

Monday's session began with a significant gap lower but immediately began to climb and for the first ninety minutes things were going the bull’s way. But shortly after 11:00 am the high of the day was painted and possession turned to the bears. Sellers methodically pushed the index lower the rest of the session with the low of the day just minutes before the close.

For the SPX Index there were 152 components advancing and 323 components declining. On the NYSE 3,155 issues were traded with 990 advancing issues and 2,056 retreating issues, a ratio of 2.08 to one declining. There were 105 new highs and 35 new lows. The five day moving average of New Highs is 167 while the five day moving average of New Lows is 26 and the ten day moving average of Net Advancing is -160.

Technically the S&P has broken support at the breakout level, now it has support at 1300, recent low. The breadth indicators are all oversold, indicating a couple days of bounce at least.

Technically the S&P has broken support at the breakout level, now it has support at 1300, recent low. The breadth indicators are all oversold, indicating a couple days of bounce at least.

There really is no reason for this market to rally without news of QE3. They are going to hold off as long as they can on this so that dollar can rally and oil and PM's can come down.

Warren Buffet Has Lost His Freakin Mind

Buffet not worried about US debt crisis, he says that kind of talk is just silly!

Sprott maintains target of 2000 for gold by year end

Sprott, who earlier this month predicted gold may climb to $2,000 US an ounce before year's end, said he started buying the metal in 2000.

"If you're in Ireland today, you don't have any money in banks, particularly if you're non-Irish," he said.

"If you're in Greece, you're taking your money out. In Portugal, you probably have concerns. If you have a fear of the banking system, you go to things like gold."

Sprott, whose hedge funds and mutual funds mostly invest in energy and metals, said silver was recently "manipulated down" after it fell $6 US in 13 minutes on a Sunday evening when trading was light.

"If you're in Ireland today, you don't have any money in banks, particularly if you're non-Irish," he said.

"If you're in Greece, you're taking your money out. In Portugal, you probably have concerns. If you have a fear of the banking system, you go to things like gold."

Sprott, whose hedge funds and mutual funds mostly invest in energy and metals, said silver was recently "manipulated down" after it fell $6 US in 13 minutes on a Sunday evening when trading was light.

Bullish Percent Gold Miners

Psychological Warfare

All the people that frequent the precious metal blogs know the reasons why they are in the metals. But fundamentals do not matter right now. This is a war to destroy your heart and mind. After a big time selling that took out the momentum traders and late comers, the war against the mid-to-long term holder is taking place. This is a war of attrition, they will try and break our resolve, make us question why we even bought the metals to begin with. The charts will change, the fundamental stories will come about and we will slowly bleed to the major averages, day after day until no one gives a crap about silver or gold.

|

| One last grasp at a straw, gold bugs index usually bottoms before the metals. You can see the MACD is almost at the low in Jan, maybe we get another down day hit that 492 mark and stop going down. |

Monday, May 16, 2011

Friday SPX Recap

Friday, we had very good reports out of France and Germany GDP came in above expectations. However, the Consumer Price Index for April rose by +0.4%, which was in line with the consensus for +0.4%. When you strip out food and energy, the so-called Core CPI came in with a gain of +0.2%, which was also in line with expectations for +0.2% and above March’s +0.1%.

Friday's session began without a gap and quickly popped up almost two points and put the high of the day on the chart just one minute after the open. The rest of the day it lingered lower, closing 10 points lower. Its critical for the SPX to stay at or above the recent breakout of the inverse HNS pattern.

The intraday volume pattern Friday clearly shows a large spike of volume right while the SPX was painting the low of the session and decreasing volume as the index tried to recover. There was clearly a lack of enthusiasm for stocks right now as we head closer to end of QE. On the down days declining volume outpaces declining issues while on the up days advancing volume rarely outpaces advancing issues. This may suggest that this pullback may have more force than we have seen in the last few pullbacks.

Friday's session began without a gap and quickly popped up almost two points and put the high of the day on the chart just one minute after the open. The rest of the day it lingered lower, closing 10 points lower. Its critical for the SPX to stay at or above the recent breakout of the inverse HNS pattern.

The intraday volume pattern Friday clearly shows a large spike of volume right while the SPX was painting the low of the session and decreasing volume as the index tried to recover. There was clearly a lack of enthusiasm for stocks right now as we head closer to end of QE. On the down days declining volume outpaces declining issues while on the up days advancing volume rarely outpaces advancing issues. This may suggest that this pullback may have more force than we have seen in the last few pullbacks.

Checking the Breadth Indicators they have completely turned around from Thursday night. The McClellan Oscillator has almost reached oversold territory going from 4.76 to (95.5).

Sunday, May 15, 2011

Silver Margin Decrease!?!

Silver may get a boost next week from this little news out of China:

Shanghai Gold Exchange Cuts Silver Margins

Subscribe to:

Comments (Atom)