Ladies and Gentlemen if you want to trade in gold and silver and learn the dynamics and the out and out criminal shenanigans, the players, the crooks what have you, then you must read Harvey Organ's Blog!

Massive Raid In Silver & Gold By Harvey Organ, Thursday, 10th march

Gold closed the comex session down $17.20 to $1412.20. Silver responded in kind also losing $1.00 to close the day at $35.04. As you will see below, the volume was huge and that is the chief ingredient to the raid. The Dow had a miserable day down 228 points as the plunge protection team could not bid up any stocks. The market did not like the PIMCO report stating that they had eliminated USA government bonds from its flagship bond fund. All of the PIMCO bond funds will follow suit.

Before I head over to the comex, for those newcomers, let me outline how the raid is orchestrated over at the comex. First the bankers send a signal the day before that a raid is coming. You need to get all the bankers in line that the raid is on for the next trading day. Then the bankers who also represent investors tell investors to hold their bids for later in the day. They will obtain gold and silver cheaper and thus they withhold their bids.

Then the bankers offer huge number of contracts at the opening with hardly anybody bidding. This dramatically forces the price down and in turn it trips all of those stop losses which in turn fuel another downturn. The bankers do not have any signal for a retreat. They only know to keep supplying massive contracts. With 20 minutes to go, they start covering their shorts as quick as they can. Whatever they cannot cover, it increases the banks total shorts in the precious metals and he see this in the COT report. I will report on this on Saturday but the COT report is from last Tuesday to this past Tuesday. I will not pick up the major raid today. Link

"Economic or market trend associated with some characteristic or phenomenon which is not cyclical or seasonal but exists over a relatively long period".

Saturday, March 12, 2011

Friday, March 11, 2011

The Channel Survives Another Day

Willam Dudley said WHAT!!

The greatest distribution of wealth is taking place in the US right now, according to some its to the level of pre-depression levels. The rich are getting richer and the number of poor (homeless, jobless) food stamp usage at all time highs 43 million people use them. This is America for godsake! Dollar Bill Dudley or as I like to call him "Big Dummy" has the freaking nerve to say "food inflation is being offset by iPad deflation".

I don't know why it took Bill Gross to sell all his US treasury debt, gee you think he smells inflation now (the enemy of bonds and currency values).

Ah, Bill how many of the jobless homeless food stamp users have Ipads, wireless connectivity are you gonna give out stamps for sprint and at&t cause the government could fund more programs with the fake money, just a thought Bill.

Is this for real?

Is this for real?

These people have lost touch with reality, No?

I'm sure the millions sleeping hungry each night will be comforted by this fact as they surf the internet on their iPad.

Dudley, who was a core advocate for the Fed's easy money policy, is seen as one of the more "dovish" members of the Fed's policy-setting Federal Open Market Committee. QE to infinity and beyond. Those of us who can see what these F%C&$ are doing protect yourselves and your assets as inflation is here to stay.

Dudley, who was a core advocate for the Fed's easy money policy, is seen as one of the more "dovish" members of the Fed's policy-setting Federal Open Market Committee. QE to infinity and beyond. Those of us who can see what these F%C&$ are doing protect yourselves and your assets as inflation is here to stay.

I don't know why it took Bill Gross to sell all his US treasury debt, gee you think he smells inflation now (the enemy of bonds and currency values).

Wake up people, I have been ranting lately, you know why I made the mistake to watch a little CNBC, and I have been furious ever since the garbage they spew with their twitting tweeting little brains make me ill. I have to stop now or i'll stroke out.

If anyone has been reading my Silver calls, i'm telling you I have never been so in tune in all the time I have traded, well maybe 1999-2000 oh yeah thats when everybody was in tune (LOL). I hit a home run today on the open, what can I say even a blind squirrel is ...

S&P Recap and A Look Inside the Markets

There was a massive earthquake in Japan last over night 8.9, I was a couple of hundred miles away from a 7.2 once and that was really scary, I can't imagine an 8.9. There are also Tsunami, warnings across New Zealand, the Philippines, Indonesia, Papua New Guinea, Hawaii, and the continued problems in the Middle East and North Africa.

Thursday's session began under intense pressure from the futures and responded with a significant gap lower. But follow-through lower was minimal as the support level at 1295 was tested and retested but support held. A steady rally attempt appeared to have been progressing when news broke that Saudi police fired on protesters a bit after 1:00 pm. The market reaction was sharp and quickly downhill for another test of the 1295 area, followed by another but much weaker bounce, leading to a fourth intraday test of support. Multiple tests generally weaken and fail so we confess to being surprised to see the fourth test today hold. And when the closing bell rang, the index was sitting on 1295 for the fifth time of the day.

They are raiding Silver again this morning, I said i would buy it back at 33, and its 60 cents away from that target (on the SLV). i'm usually a little early but I think its a great day to re-enter, my next short-term target is 41. So bring the pain "JP Morgue".

The S&P is going to gap down this morning through the 50dma which had been good support for a really long time. Time to say bye bye to that. If I was going to short it would not be this move, it would be the bounce back to the 50dma after sometime below it, the fall off of that bounce is usually the most profitable.

Yesterday, a downgrade of Spain, more fighting in Libya and concerns about China's growth created large pullbacks in the foreign markets, which also carried over to the U.S. futures. Initial Claims for Unemployment Insurance for the week ending March 5th rose by 18K to 397K. This was above the consensus estimate for 379K and last week’s total of 371K. Continuing Claims for the week ending 2/26 came in at 3.771M vs. 3.753M. The U.S. Trade Deficit also rose in January to $46.3 billion, which was worse than the consensus estimate for a deficit of $41.4 billion.

Yesterday, a downgrade of Spain, more fighting in Libya and concerns about China's growth created large pullbacks in the foreign markets, which also carried over to the U.S. futures. Initial Claims for Unemployment Insurance for the week ending March 5th rose by 18K to 397K. This was above the consensus estimate for 379K and last week’s total of 371K. Continuing Claims for the week ending 2/26 came in at 3.771M vs. 3.753M. The U.S. Trade Deficit also rose in January to $46.3 billion, which was worse than the consensus estimate for a deficit of $41.4 billion.

Thursday's session began under intense pressure from the futures and responded with a significant gap lower. But follow-through lower was minimal as the support level at 1295 was tested and retested but support held. A steady rally attempt appeared to have been progressing when news broke that Saudi police fired on protesters a bit after 1:00 pm. The market reaction was sharp and quickly downhill for another test of the 1295 area, followed by another but much weaker bounce, leading to a fourth intraday test of support. Multiple tests generally weaken and fail so we confess to being surprised to see the fourth test today hold. And when the closing bell rang, the index was sitting on 1295 for the fifth time of the day.

New Lows outnumbered New Highs today; this has been exceptionally rare for the last two years, last happening on November 16th and before that on August 25th. Breadth was abysmal today however, the ten day average of New Advancing remains in positive (slightly).

Volume today was heavier than the ten day average but not as heavy as might be expected on a plunge like we saw today. The intraday volume pattern is quite interesting. We had a volume spike with the index moving higher just after 1:00 pm then when the Saudi news hit the market, a huge volume spike while the index was selling. Checking the Breadth Indicators reveals still a mixed bag but the McClellan Oscillator has moved into oversold territory while the Summation Index hasn't gotten anywhere close to negative ground.

For the SPX Index there were 27 components advancing and 456 components declining. On the NYSE 3,120 issues were traded with 487 advancing issues and 2,557 retreating issues, a ratio of 5.25 to one declining. There were 27 new highs and 31 new lows. The five day moving average of New Highs is 154 while the five day moving average of New Lows is 17 and the ten day moving average of Net Advancing is 97.

Declining volume was higher at a ratio of 9.07 to one. The closing TRIN was 1.84 and the final tick was -695. The five day average of TRIN is 1.36 and the ten day average of TRIN is 1.28. The NYSE Composite Index lost -2.14% today while the SPX lost -1.92%.

For the NYSE, relative to the previous 30 session average, volume was 8.78% above the average. Of the last 15 sessions 8 sessions ended with volume greater than the previous rolling 30 day average volume. Of the last 30 sessions, 23 sessions ended on a positive tick, 8 of last 10. For the SPX, the day's volume was 111.4% of the average daily volume for the last year. Volume was 113.4% of the last 10 day average and 123.2% of the previous day’s volume.

Declining volume was higher at a ratio of 9.07 to one. The closing TRIN was 1.84 and the final tick was -695. The five day average of TRIN is 1.36 and the ten day average of TRIN is 1.28. The NYSE Composite Index lost -2.14% today while the SPX lost -1.92%.

For the NYSE, relative to the previous 30 session average, volume was 8.78% above the average. Of the last 15 sessions 8 sessions ended with volume greater than the previous rolling 30 day average volume. Of the last 30 sessions, 23 sessions ended on a positive tick, 8 of last 10. For the SPX, the day's volume was 111.4% of the average daily volume for the last year. Volume was 113.4% of the last 10 day average and 123.2% of the previous day’s volume.

Sector Performance:

- Consumer Staples -- Outperformed the SPX by +122%.

- Utilities -- Outperformed the SPX by +75%.

- Health Care -- Outperformed the SPX by +31%.

- Consumer Discretionary -- Outperformed the SPX by +60%.

Sectors weaker than the SPX for Thursday:

- Basic Materials -- Underperformed the SPX by -26%.

- Energy -- Underperformed the SPX by -180%.

- Financials -- Underperformed the SPX by -20%.

- Industrials -- Underperformed the SPX by -15%.

- Technology -- Underperformed the SPX by -8%.

- Consumer Staples -- Outperformed the SPX by +122%.

- Utilities -- Outperformed the SPX by +75%.

- Health Care -- Outperformed the SPX by +31%.

- Consumer Discretionary -- Outperformed the SPX by +60%.

Sectors weaker than the SPX for Thursday:

- Basic Materials -- Underperformed the SPX by -26%.

- Energy -- Underperformed the SPX by -180%.

- Financials -- Underperformed the SPX by -20%.

- Industrials -- Underperformed the SPX by -15%.

- Technology -- Underperformed the SPX by -8%.

Spanish Banks Seek Investors to Plug $21 Billion Shortfall

Spanish banks that together need as much as 15.2 billion euros ($21 billion) to meet minimum capital levels now must persuade investors that their battered balance sheets offer the potential return to match the risk.

Twelve lenders, including eight savings banks and the Spanish units of Deutsche Bank AG (DBK) and Barclays Plc (BARC), are among the lenders that fell short of government-set capital requirements, the Bank of Spain said yesterday. The institutions whose levels are furthest from the required minimums include Bankia, which needs 5.8 billion euros, Novacaixagalicia, which needs 2.6 billion euros, CatalunyaCaixa and Unnim.

Twelve lenders, including eight savings banks and the Spanish units of Deutsche Bank AG (DBK) and Barclays Plc (BARC), are among the lenders that fell short of government-set capital requirements, the Bank of Spain said yesterday. The institutions whose levels are furthest from the required minimums include Bankia, which needs 5.8 billion euros, Novacaixagalicia, which needs 2.6 billion euros, CatalunyaCaixa and Unnim.

Saudi King Counters Protests With $36 Billion as Tension Mounts

As unrest escalated across the Middle East, activists in Saudi Arabia demanded a political voice as well. Rather than promises of democracy, they got a $36 billion handout and a slap down from Islamic clerics.

Saudi academics, writers and representatives of the minority Shiite Muslim population called on King Abdullah, the sixth monarch in the Arab world’s largest economy, to move the country toward a constitutional monarchy. Anti-government demonstrators are advocating a “Day of Rage” today.

“Demands for political reform will inevitably increase in the kingdom as democracy takes root in the region,” said Thomas Hegghammer, a senior research fellow at the Norwegian Defense Research Establishment in Oslo and author of “Jihad in Saudi Arabia.” “If the regime does nothing, tension will grow between conservative and progressive factions.”

Saudi academics, writers and representatives of the minority Shiite Muslim population called on King Abdullah, the sixth monarch in the Arab world’s largest economy, to move the country toward a constitutional monarchy. Anti-government demonstrators are advocating a “Day of Rage” today.

“Demands for political reform will inevitably increase in the kingdom as democracy takes root in the region,” said Thomas Hegghammer, a senior research fellow at the Norwegian Defense Research Establishment in Oslo and author of “Jihad in Saudi Arabia.” “If the regime does nothing, tension will grow between conservative and progressive factions.”

Quake, Tsunami Hit Japan Causing `Major' Damage; 26 Dead

Japan was struck by its strongest earthquake in at least a century, an 8.9-magnitude temblor that shook buildings across Tokyo and unleashed a tsunami as high as 10 meters, engulfing towns along the northern coast. Going to sell uranium miners and ETF as there is talk of nuclear plant damage and this will start some market panic me thinks???

Link

Link

Thursday, March 10, 2011

QE to Infinity and beyond

$25,000,000,000 POMO Thursday at 0% interest to short commodities, right is this legal Oh hell yea and even encouraged. They gotta keep commodity prices down somehow. This is a buying opportunity (as far as i'm concerned, increased positions in AG and XLE today), they are saying commodities are down on global growth concerns, are you KIDDING, what about all the money being printed all over the world, financial media forgets so quickly.

The FED can't stop the QE PONZI SCHEME, did you see that PIMCO dumped all US back debt, soon there will be no one left holding the bag. Where is the sanity?

The FED can't stop the QE PONZI SCHEME, did you see that PIMCO dumped all US back debt, soon there will be no one left holding the bag. Where is the sanity?

Take my word for it QE is here to stay! QE to infinity and beyond.

At this pooint the federal reserve owns at least three quarters of the treasury market, HELLO!

Suppose they stop buying, do you think China, Japan, and UK will step up, HELL NO. They are already dumping it like toxic waste. There will be no buyers and how do you think were gonna raise 1,500,000,000,000 dollars to cover just the deficit for this year? And then what about next year. You don't really think they will raise rates to attract foreign investment, thats the only way to get people suckered back in

The catch 22 in the Ponzi scheme is that if rates go up the scheme fails, we'll default. If the Ponzi scheme was to work that is, we created jobs, more tax revenue and cut spending NAH!!!!.

QE WILL NEVER STOP

S&P Hit Short-term target

Like clockwork wow!, I'm usually never right about this stuff, and its making me a little nervous. Wait, I hear talk of QE3, yes seriously, that should keep the selling pressure down. Maybe we stay in this channel for a while, I really haven't a clue right now. gotta lot of reading to do tonight. I sold half of the ZSL I bought Monday for a quick 8%, I don't think the shorts will press over the weekend due to middle east issues.

SILVER UPDATE

Don't have a lotta time, but I have been talking about taking profits and hedging on Silver positions, well "The JP Morgue" is beginning a raid this morning. This might get really ugly its a small market and there were rumors of massive losses in billions if silver stays above 36, so they are really kicking the crap out if it right now.

I'd love to buy back at 33!!

Look at silver live chart bottom of blog

I'd love to buy back at 33!!

Look at silver live chart bottom of blog

S&P Recap and A Look Inside the Markets

Good morning! Before I go on to the recap I have to talk about something that is really starting to bug me and that is the constant annoying rhetoric by financial media and their guests pointing to a strengthening economy based on an improving job market, higher wages and low inflation, really?!? Where do these people live? Not on earth!

If the labor market is improving, how come the long term jobless benefits number and the number of people on food stamps increases nearly every week? 43 million people in the US receiving food stamps, 45 million people are living below the poverty line, these numbers are increasing not decreasing, 700 thousands Americans are homeless.

I just paid $3.95/gallon for gasoline. In late November I was paying 3 bucks at the same gas station. The Continuous Commodity Index – CCI, (60% food, 17% energy and 23% metals) has almost doubled since the low in early 2009 and has gone up 42% in the last 12 months.

I'm done with the rant, though I don't feel any better. In any case, yesterday the stock futures were a little below fair value and off their overnight highs by several points. In the news we had Libyan officials flying to Cairo carrying a message from Gadhafi, a less-than inspiring auction in Portugal, and mixed foreign markets. The S&P futures are down 7 points this morning as the battle for control of Libya and weaker than expected Chinese economic data weighed on markets Thursday while a debt rating downgrade of Spain hit the euro and the bank of England held rates where they were, sighting weak economic conditions.

Moammar Gadhafi (by the way I loved his appearance on SNL) appears to be recapturing ground lost to rebels, investors remain cautious of staking out fresh positions given worries over oil supplies and how the crisis in the Arab world will spread.

Trapped between 1333 and 1295, great trading op for swing traders!

The session began without a significant gap and quickly moved lower before bouncing back into positive ground. But sellers then arrived to sharply take the index back down to the low of the day at 11:00 am. It looked like the bears were in control but they couldn't hold it.

Buyers took the tape quickly up ten points by noon before the SPX spent the entire afternoon in a sideways pattern hovering around the 1320 support/resistance level. This was a ten point range day but the afternoon traded like a three point range.

On the NYSE 3,135 issues were traded with 1,434 advancing issues and 1,599 retreating issues, a ratio of 1.12 to one declining. There were 160 new highs and 10 new lows. The five day moving average of New Highs is 159 while the five day moving average of New Lows is 12 and the ten day moving average of Net Advancing is 325. The Net Advancing data indicates a bullish trend.

Volume was light today and the only thing that jumps out at us was the volume spike early today on the downward move without a corresponding volume spike on the ensuing upward rally. Looking at the Breadth Indicators once again we see a mixed group but leaning towards the bearish side last night and the futures are playing that out this morning.

Sectors stronger than the SPX for Wednesday:

- Financials -- Outperformed the SPX by +8%.

- Consumer Staples -- Outperformed the SPX by +81%.

- Utilities -- Outperformed the SPX by +115%.

- Health Care -- Outperformed the SPX by +29%.

- Consumer Discretionary -- Outperformed the SPX by +37%.

Sectors weaker than the SPX for Wednesday:

- Basic Materials -- Underperformed the SPX by -141%.

- Energy -- Underperformed the SPX by -49%.

- Industrials -- Underperformed the SPX by -8%.

- Technology -- Underperformed the SPX by -27%.

I just paid $3.95/gallon for gasoline. In late November I was paying 3 bucks at the same gas station. The Continuous Commodity Index – CCI, (60% food, 17% energy and 23% metals) has almost doubled since the low in early 2009 and has gone up 42% in the last 12 months.

I'm done with the rant, though I don't feel any better. In any case, yesterday the stock futures were a little below fair value and off their overnight highs by several points. In the news we had Libyan officials flying to Cairo carrying a message from Gadhafi, a less-than inspiring auction in Portugal, and mixed foreign markets. The S&P futures are down 7 points this morning as the battle for control of Libya and weaker than expected Chinese economic data weighed on markets Thursday while a debt rating downgrade of Spain hit the euro and the bank of England held rates where they were, sighting weak economic conditions.

Moammar Gadhafi (by the way I loved his appearance on SNL) appears to be recapturing ground lost to rebels, investors remain cautious of staking out fresh positions given worries over oil supplies and how the crisis in the Arab world will spread.

Trapped between 1333 and 1295, great trading op for swing traders!

The session began without a significant gap and quickly moved lower before bouncing back into positive ground. But sellers then arrived to sharply take the index back down to the low of the day at 11:00 am. It looked like the bears were in control but they couldn't hold it.

Buyers took the tape quickly up ten points by noon before the SPX spent the entire afternoon in a sideways pattern hovering around the 1320 support/resistance level. This was a ten point range day but the afternoon traded like a three point range.

On the NYSE 3,135 issues were traded with 1,434 advancing issues and 1,599 retreating issues, a ratio of 1.12 to one declining. There were 160 new highs and 10 new lows. The five day moving average of New Highs is 159 while the five day moving average of New Lows is 12 and the ten day moving average of Net Advancing is 325. The Net Advancing data indicates a bullish trend.

Volume was light today and the only thing that jumps out at us was the volume spike early today on the downward move without a corresponding volume spike on the ensuing upward rally. Looking at the Breadth Indicators once again we see a mixed group but leaning towards the bearish side last night and the futures are playing that out this morning.

Sectors stronger than the SPX for Wednesday:

- Financials -- Outperformed the SPX by +8%.

- Consumer Staples -- Outperformed the SPX by +81%.

- Utilities -- Outperformed the SPX by +115%.

- Health Care -- Outperformed the SPX by +29%.

- Consumer Discretionary -- Outperformed the SPX by +37%.

Sectors weaker than the SPX for Wednesday:

- Basic Materials -- Underperformed the SPX by -141%.

- Energy -- Underperformed the SPX by -49%.

- Industrials -- Underperformed the SPX by -8%.

- Technology -- Underperformed the SPX by -27%.

Wednesday, March 09, 2011

PIMCO Total Return dumps U.S. government-related debt

(Reuters) - The world's largest bond fund has gone ultra bearish on the United States, dumping all of its U.S. government-related debt holdings.

The move by Bill Gross's $236.9 billion PIMCO Total Return fund completed last month comes in the wake of a vicious Treasury market sell-off and just days after he questioned who will buy Treasuries once the Federal Reserve halts its latest round of bond purchases in June.

Gross, who also helps oversee a $1.1 trillion investment portfolio as PIMCO's co-chief investment officer, has repeatedly warned against U.S. deficit spending and its inflationary impact, which undermine the value of government debt and push up yields as investors demand more compensation for risk.

Over the last five months, worries over the ballooning U.S. budget gap estimated at $1.645 trillion for 2011, political stalemate in Washington over how to narrow it and inflationary fears have all contributed to a steep sell-off in Treasuries.

The move by Bill Gross's $236.9 billion PIMCO Total Return fund completed last month comes in the wake of a vicious Treasury market sell-off and just days after he questioned who will buy Treasuries once the Federal Reserve halts its latest round of bond purchases in June.

Gross, who also helps oversee a $1.1 trillion investment portfolio as PIMCO's co-chief investment officer, has repeatedly warned against U.S. deficit spending and its inflationary impact, which undermine the value of government debt and push up yields as investors demand more compensation for risk.

Over the last five months, worries over the ballooning U.S. budget gap estimated at $1.645 trillion for 2011, political stalemate in Washington over how to narrow it and inflationary fears have all contributed to a steep sell-off in Treasuries.

S&P Recap and A Look Inside the Markets

The S&P futures are up slightly this morning, Oil is down and there really isn't much in the way of news as yet. Yesterday there were conflicting reports this morning about the situation in Libya. The word was that Qaddafi had offered to negotiate stepping down in return for a guarantee of safe passage out of the country. However, the opposition rejected talks. This led Qaddafi forces to again use air strikes against the rebels. Also on the oil front, there were reports that some OPEC members are working to increase oil production. Germany's Industrial Orders rose in January and the NFIB Small Business Optimism index gained ground again here in the U.S. But futures were well below their overnight highs as the open approached.

The session began without much of a gap, moved upward for a couple minutes, then quickly reversed and sold off six points to put the low of the day on the chart at 9:47. Then bulls took over and by noon they had run the index up almost eighteen points putting the high of the day on the chart at 12:02 pm. The afternoon hours saw a gentle decline on light volume before finishing at about 80% of the intraday range. Remember that key level, as i mentioned before I don't think we take that out before we make a new low around or slightly below the 50dma. I had also written that the technical indicators were signaling a two day rally, so I will take on a new short position at or close to that 1333-1332 level.

The session began without much of a gap, moved upward for a couple minutes, then quickly reversed and sold off six points to put the low of the day on the chart at 9:47. Then bulls took over and by noon they had run the index up almost eighteen points putting the high of the day on the chart at 12:02 pm. The afternoon hours saw a gentle decline on light volume before finishing at about 80% of the intraday range. Remember that key level, as i mentioned before I don't think we take that out before we make a new low around or slightly below the 50dma. I had also written that the technical indicators were signaling a two day rally, so I will take on a new short position at or close to that 1333-1332 level.

For the SPX Index there were 395 components advancing and 85 components declining. On the NYSE 3,142 issues were traded with 2,312 advancing issues and 741 retreating issues, a ratio of 3.12 to one advancing. There were 149 new highs and 10 new lows. The five day moving average of New Highs is 149 while the five day moving average of New Lows is 14 and the ten day moving average of Net Advancing is 253. The Net Advancing data indicates a bullish trend.Intraday volume was high during the morning rally and declined all afternoon as the market softened.

Total tick for the day was 357,000 and the average tick for the day was 231. There were 234 ticks greater than 600 and 38 ticks more extreme than -600. There were 22 ticks greater than 1000 and no ticks more extreme than -1000. The tick action suggests institutional accumulation.

Breadth was strong and the ten day average of Net Advancing wasted no time in getting back into bullish territory. But the SPX outperformed the broader NYSE Composite Index today and that might suggest that the SPX over reached.

Total tick for the day was 357,000 and the average tick for the day was 231. There were 234 ticks greater than 600 and 38 ticks more extreme than -600. There were 22 ticks greater than 1000 and no ticks more extreme than -1000. The tick action suggests institutional accumulation.

Breadth was strong and the ten day average of Net Advancing wasted no time in getting back into bullish territory. But the SPX outperformed the broader NYSE Composite Index today and that might suggest that the SPX over reached.

Sectors stronger than the SPX for Tuesday:

- Basic Materials -- Outperformed the SPX by +22%.

- Financials -- Outperformed the SPX by +129%.

- Industrials -- Outperformed the SPX by +56%.

- Utilities -- Outperformed the SPX by +23%.

Sectors weaker than the SPX for Tuesday:

- Energy -- Underperformed the SPX by -172%.

- Technology -- Underperformed the SPX by -6%.

- Consumer Staples -- Underperformed the SPX by -8%.

- Health Care -- Underperformed the SPX by -35%.

- Consumer Discretionary -- Underperformed the SPX by -9%.

- Basic Materials -- Outperformed the SPX by +22%.

- Financials -- Outperformed the SPX by +129%.

- Industrials -- Outperformed the SPX by +56%.

- Utilities -- Outperformed the SPX by +23%.

Sectors weaker than the SPX for Tuesday:

- Energy -- Underperformed the SPX by -172%.

- Technology -- Underperformed the SPX by -6%.

- Consumer Staples -- Underperformed the SPX by -8%.

- Health Care -- Underperformed the SPX by -35%.

- Consumer Discretionary -- Underperformed the SPX by -9%.

Tuesday, March 08, 2011

S&P Recap and A Look Inside the Markets

Good Morning! S&P futures are up almost four points, there is news this morning that US employers are begining to hire (yawn) and that OPEC is going to boost oil production (right!).

Yesterday, Despite the downgrade of Greece's sovereign debt rating, air attacks on rebel forces in Libya, and the price of oil gushing above $106, European stock markets and U.S. stock futures were holding up fairly well before our open. There was no economic data to review before the open today while we did get a report on Consumer Credit at 3:00 pm. But a January credit report in March really has that feel of a lagging indicator.

The week began without a significant gap and quickly moved higher putting the high of the session on the chart several times during the first thirty-five minutes of trading, once again failing the level I have been writing about. But then sellers took command and S&P went down hard, dropping more than twenty points without anything but tiny bounces along the way. But the low of the day was painted soon after 1:00 pm and the SPX began to slowly work its way higher. The final hour saw the pace pick up as the index moved higher until the last fifteen minutes and closed almost seven points off the lows.

For the fifth time in the last six sessions we have seen an early session high followed by a later day low. Clearly this markets behavior has changed.

- Financials -- Outperformed the SPX by +4%.

- Consumer Staples -- Outperformed the SPX by +56%.

- Utilities -- Outperformed the SPX by +122%.

- Health Care -- Outperformed the SPX by +6%.

Sectors weaker than the SPX for Monday:

- Basic Materials -- Underperformed the SPX by -95%.

- Industrials -- Underperformed the SPX by -10%.

- Technology -- Underperformed the SPX by -3690%.

- Consumer Discretionary -- Underperformed the SPX by -17%.

Yesterday, Despite the downgrade of Greece's sovereign debt rating, air attacks on rebel forces in Libya, and the price of oil gushing above $106, European stock markets and U.S. stock futures were holding up fairly well before our open. There was no economic data to review before the open today while we did get a report on Consumer Credit at 3:00 pm. But a January credit report in March really has that feel of a lagging indicator.

The week began without a significant gap and quickly moved higher putting the high of the session on the chart several times during the first thirty-five minutes of trading, once again failing the level I have been writing about. But then sellers took command and S&P went down hard, dropping more than twenty points without anything but tiny bounces along the way. But the low of the day was painted soon after 1:00 pm and the SPX began to slowly work its way higher. The final hour saw the pace pick up as the index moved higher until the last fifteen minutes and closed almost seven points off the lows.

For the fifth time in the last six sessions we have seen an early session high followed by a later day low. Clearly this markets behavior has changed.

Breadth was even worse today than it might have appeared; it was worse today than Friday. The ten day average of Net Advancing has plunged below zero for the first time in five weeks and is at its lowest since November 26th. The volume today was not particularly robust for a convincing down day and the TRIN is suggesting that we are due for a bounce. Tick shows institutional distribution, Total tick for the day was -244,000 and the average tick for the day was -157. There were 63 ticks greater than 600 and 231 ticks more extreme than -600. There were 7 ticks greater than 1000 and 32 ticks more extreme than -1000.

Volume was heavy during the down move early today and then tapered off during the afternoon while the index was moving higher. Looking at the Breadth indicators two things catch my immediate attention. First, the McClellan Oscillator moved into oversold territory where we will frequently see a bounce. Second, the McClellan Summation Index hasn't approached anything near negative territory. Both of these suggest the possibility that this downturn won't be long lasting, or at least the possibility of a one or two session bounce.

Sector performance for Monday:

- Energy -- Outperformed the SPX by +5%.- Financials -- Outperformed the SPX by +4%.

- Consumer Staples -- Outperformed the SPX by +56%.

- Utilities -- Outperformed the SPX by +122%.

- Health Care -- Outperformed the SPX by +6%.

Sectors weaker than the SPX for Monday:

- Basic Materials -- Underperformed the SPX by -95%.

- Industrials -- Underperformed the SPX by -10%.

- Technology -- Underperformed the SPX by -3690%.

- Consumer Discretionary -- Underperformed the SPX by -17%.

Monday, March 07, 2011

Saudi Oil Production and Reserves

Saudi Oil Production and Reserves – Reasons Behind Wikileaks Concerns

Posted by Gail the Actuary on February 9, 2011 – 11:54am

The UK Guardian published an article yesterday titled WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices, talking about the possibility that as soon as 2012, world oil production may begin to decline because of “peak oil”. Saudi Arabia may not be able to raise production as much as claimed, and its reserves may be overstated by 40%. Leanan has put together a post with more about the cables. The Wikileak cables can be found here or here. In this post, we provide a few graphs, plus some links to (and excerpts from) prior posts by Oil Drum staff members about Saudi Arabia’s true situation.

Saudi Arabia tells us that they have lots of oil, but if we look at graphs of their historical production, there is nothing that looks like an upward trend. In fact, recent production is lower than it was in the late 1970s and early 1980s. This is a graph of Saudi oil production, consumption, and amount of net exports, from Energy Exports Data browser.

Posted by Gail the Actuary on February 9, 2011 – 11:54am

The UK Guardian published an article yesterday titled WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices, talking about the possibility that as soon as 2012, world oil production may begin to decline because of “peak oil”. Saudi Arabia may not be able to raise production as much as claimed, and its reserves may be overstated by 40%. Leanan has put together a post with more about the cables. The Wikileak cables can be found here or here. In this post, we provide a few graphs, plus some links to (and excerpts from) prior posts by Oil Drum staff members about Saudi Arabia’s true situation.

Saudi Arabia tells us that they have lots of oil, but if we look at graphs of their historical production, there is nothing that looks like an upward trend. In fact, recent production is lower than it was in the late 1970s and early 1980s. This is a graph of Saudi oil production, consumption, and amount of net exports, from Energy Exports Data browser.

Hello Everyone

I usually don't look at the stats for my blog, but I have noticed that 50% of blog audience is from the US and I am getting a lot of page views from people in other parts of the world. So to all of you I say WELCOME!!!

I was extremely happy to see that a large portion of blogs audience is from Vietnam (25%), India (5%), Ukraine(3%), Russia (3%), UAE(1%), China (10%), Hong Kong (5%) and Iran (1%) to be reading my blog!

I would love it if you would post some comments and we could interact.

best wishes to all!

I was extremely happy to see that a large portion of blogs audience is from Vietnam (25%), India (5%), Ukraine(3%), Russia (3%), UAE(1%), China (10%), Hong Kong (5%) and Iran (1%) to be reading my blog!

I would love it if you would post some comments and we could interact.

best wishes to all!

SLV Update

This maybe the day to take some profit in Silver, this is a big volume day so far and we could correct for a few days back down to the 33-32 range on the SLV. I went long ZSL (double short Silver) this morning, a small position as a hedge as I had sold have my position a day too early as usual.

As for the S&P as I mentioned the other day the character of the market has changed. Buying the dip is not working anymore. I would be loathe be long at this time, we probably will test 1294 before we test 1332, and not so sure it will hold this time.

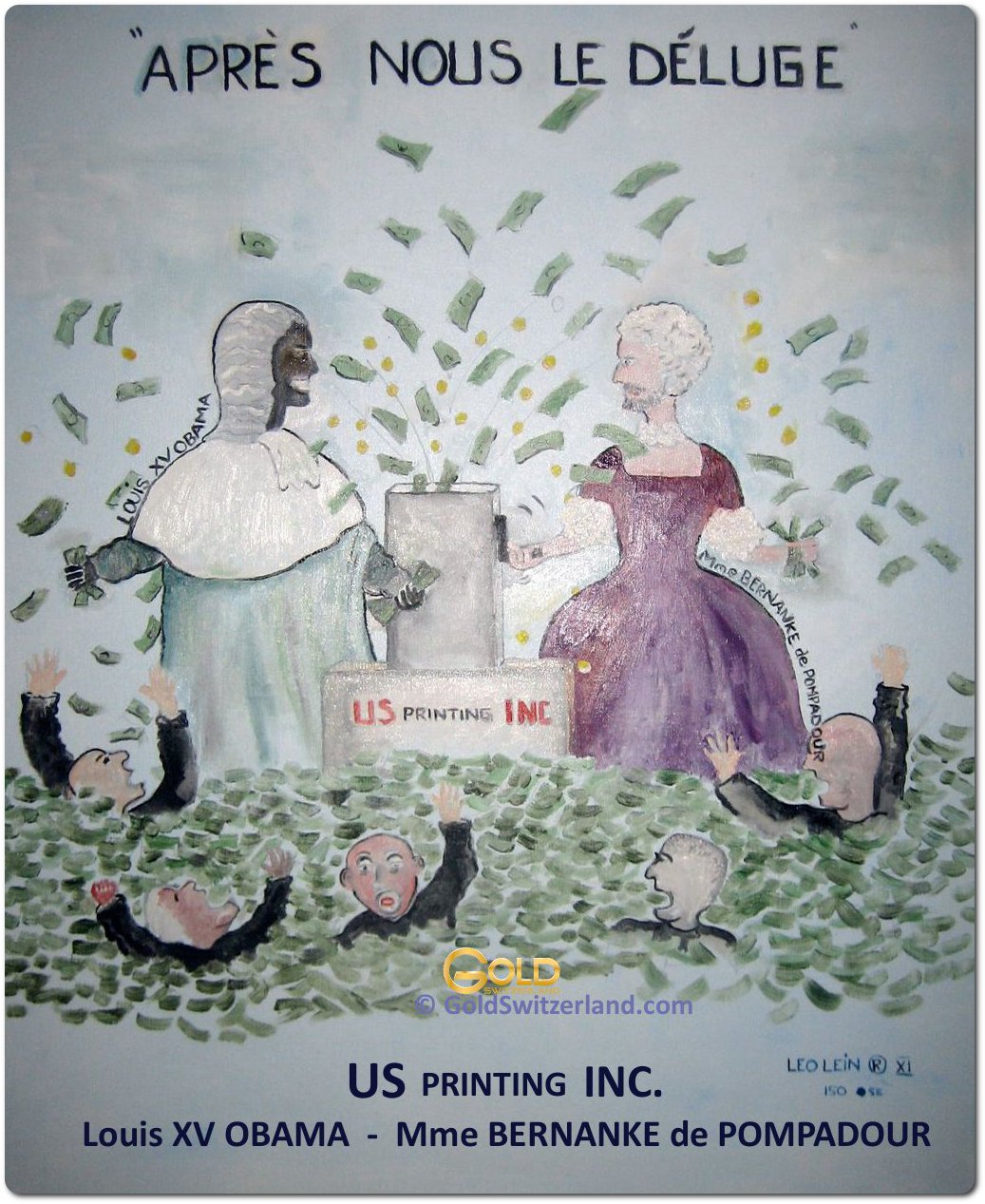

Brilliant Post, A Must Read; APRES NOUS LE DELUGE by Egon von Greyerz

Happy days are here again! Stock markets are strong, company profits are up, bankers are making record profits and bonuses, unemployment is declining, and inflation is non-existent. Obama and Bernanke are the dream team making the US into the Superpower it once was.

Yes, it is amazing the castles in the air that can be built with paper money and deceitful manipulation of all economic data. And Madame Bernanke de Pompadour will do anything to keep King Louis XV Obama happy, including flooding markets with unlimited amounts of printed money. They both know that, in their holy alliance, they are committing a cardinal sin. But clinging to power is more important than the good of the country. An economic and social disaster is imminent for the US and a major part of the world and Bernanke de Pompadour and Louis XV Obama are praying that it won’t happen during their reign: “Après nous le déluge”. (Warm thanks to my good friend the artist Leo Lein).

Yes, it is amazing the castles in the air that can be built with paper money and deceitful manipulation of all economic data. And Madame Bernanke de Pompadour will do anything to keep King Louis XV Obama happy, including flooding markets with unlimited amounts of printed money. They both know that, in their holy alliance, they are committing a cardinal sin. But clinging to power is more important than the good of the country. An economic and social disaster is imminent for the US and a major part of the world and Bernanke de Pompadour and Louis XV Obama are praying that it won’t happen during their reign: “Après nous le déluge”. (Warm thanks to my good friend the artist Leo Lein).

S&P Recap, a look ahead

This was just slightly below the consensus estimates for an increase of 198,000 (Manufactured). The January totals were revised higher to 58K from 36K and the combination of revisions for January and December produced an increase of 58K jobs. The private sector showed gains of 222K jobs (lie some more), which again was above the estimates. The Unemployment Rate was once again a big surprise as it fell to 8.9% (Really?!?), which was below the expectations for a reading of 9.1% and January’s level of 9.0%. Although stock futures initially rallied on the jobs report, crude's continued rude rise pushed prices lower as the open approached.

Friday's session began quietly without a significant gap. But sellers were waiting and the first half hour was gently downhill. Then at 10:00 am the action escalated and the selling picked up. The following thirty minutes gave up eight points before the SPX stabilized and tried to rally back. After oscillating up and down and back up about four points over seventy-five minutes the index rolled over almost twelve points in a half hour. This was essentially the low of the session but it was tested several times later in the day. But the last thirty minutes saw a ferocious ten point recovery as the index exploded upward to close near the midpoint of the intraday range.

As we go into trade today remember that 1332 level that we hit last Tuesday and could not take out on Thursday and Failed Friday as well. If I was long the SPY (S&P ETF) its time to be very cautious. These gyrations are a part of an extended bull run coming to a close. Initially, the mind that has been trained by the markets goes into a state of denial, refusing to admit that its over. But then sadistically teased by the big up moves that invite in more money for fear of missing out, only to be left hanging in misery.

If I were bullish on US equities at these levels which I am not, I would wait for the market to take out 1332. There is too much downside risk right now, especially given the political environment.

Declining volume was higher at a ratio of 3.13 to one. The closing TRIN was 1.85 and the final tick was 407. The five day average of TRIN is 1.43 and the ten day average of TRIN is 1.32. The NYSE Composite Index lost -0.62% today while the SPX lost -0.74%.

For the NYSE, relative to the previous 30 session average, volume was -1.94% below the average. Of the last 15 sessions 7 sessions ended with volume greater than the previous rolling 30 day average volume. Of the last 30 sessions, 24 sessions ended on a positive tick, 7 of last 10. For the SPX, the day's volume was 101.9% of the average daily volume for the last year. Volume was 97.6% of the last 10 day average and 103.5% of the previous day’s volume.

Breadth was negative as would be expected on a down day and negative volume was even more negative than issues.

Total tick for the day was -193,000 and the average tick for the day was -124. There were 60 ticks greater than 600 and 162 ticks more extreme than -600. There were 8 ticks greater than 1000 and 12 ticks more extreme than -1000. The tick action suggests institutional distribution.

Clearly the big volume spike Friday was with the index breakdown midday. The late data rally, on the other hand, was on falling volume.

Sectors Performance or Friday:

- Basic Materials -- Outperformed the SPX by +1%.

- Energy -- Outperformed the SPX by +4%.

- Consumer Staples -- Outperformed the SPX by +31%.

- Utilities -- Outperformed the SPX by +14%.

- Health Care -- Outperformed the SPX by +61%.

Sectors weaker than the SPX for Friday:

- Financials -- Underperformed the SPX by -48%.

- Industrials -- Underperformed the SPX by -42%.

- Technology -- Underperformed the SPX by -6%.

- Consumer Discretionary -- Underperformed the SPX by -1%.

- Basic Materials -- Outperformed the SPX by +1%.

- Energy -- Outperformed the SPX by +4%.

- Consumer Staples -- Outperformed the SPX by +31%.

- Utilities -- Outperformed the SPX by +14%.

- Health Care -- Outperformed the SPX by +61%.

Sectors weaker than the SPX for Friday:

- Financials -- Underperformed the SPX by -48%.

- Industrials -- Underperformed the SPX by -42%.

- Technology -- Underperformed the SPX by -6%.

- Consumer Discretionary -- Underperformed the SPX by -1%.

Subscribe to:

Comments (Atom)