- ( RTR ) 04/21 02:30PM OBAMA SAYS HAS ASKED ATTORNEY GENERAL TO CREATE TEAM TO "ROOT OUT" FRAUD, MANIPULATION IN OIL MARKETS THAT COULD HIT GAS PRICES

- ( RTR ) 04/21 02:31PM OBAMA, IN PREPARED REMARKS, SAYS TEAM'S FOCUS WILL INCLUDE OIL MARKET TRADERS AND SPECULATORS

- ( RTR ) 04/21 02:31PM OBAMA SAYS WILL MAKE SURE THAT NO ONE IN OIL MARKET IS TAKING ADVANTAGE OF THE AMERICAN PEOPLE FOR THEIR OWN SHORT-TERM GAIN

Goldman Sachs, Morgan Stanley, BP, TOT, Shell, DB and Societe General founded the Intercontinental Exchange in 2000. ICE is an online commodities and futures marketplace. It is outside the US and operates free from the constraints of US laws. The exchange was set up to facilitate ”dark pool” trading in the commodities markets. Billions of dollars are being placed on oil futures contracts at the ICE and the beauty of this scam is that they never take delivery.

Of course there is manipulation in Oil (thats how it was set up) but its hilarious they want to talk about it now. They give the big banks billions in free paper, what do you think they are going to do with it, put it under the mattress? STOP giving them money. Think about it they are using our tax dollars, bailout money, and the POMO funds to then bid up everything, all the stuff we use.

A week ago Owe-bama was telling people to buy more fuel efficient cars and get rid of gas guzzlers...now he wants to root out fraud and corruption in the oil markets...why didn't he attack fraud and corruption in the sub-prime, maybe because of all the former banksters now in Washington. They just brushed trillions under the rug.

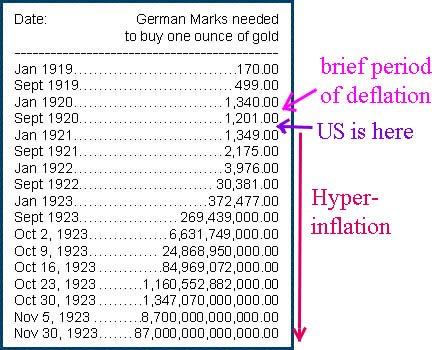

Everyone knows this goes on in many other markets as well, but since Oil is now on everyones radar they bring it up. I maybe naive in saying oil manipulation probably effects price 20 bucks a barrel at this point (in terms of price swings) if that. The main problem is the inflation caused by government policies, printing money, deficits and runaway spending. Seen the dollar chart lately. C'MON MAN!

A week ago Owe-bama was telling people to buy more fuel efficient cars and get rid of gas guzzlers...now he wants to root out fraud and corruption in the oil markets...why didn't he attack fraud and corruption in the sub-prime, maybe because of all the former banksters now in Washington. They just brushed trillions under the rug.

Everyone knows this goes on in many other markets as well, but since Oil is now on everyones radar they bring it up. I maybe naive in saying oil manipulation probably effects price 20 bucks a barrel at this point (in terms of price swings) if that. The main problem is the inflation caused by government policies, printing money, deficits and runaway spending. Seen the dollar chart lately. C'MON MAN!